THE MILLENIAL'S ULTIMATE GUIDE TO MANAGING MONEY

Money might make the world go round, but it can be tough to keep those dolla dolla bills organized. Whether you’re financially independent for the first time or in need of a personal finances refresher course, here are some tips for smart money management.

Note: The following information is based on an unmarried, childless adult.

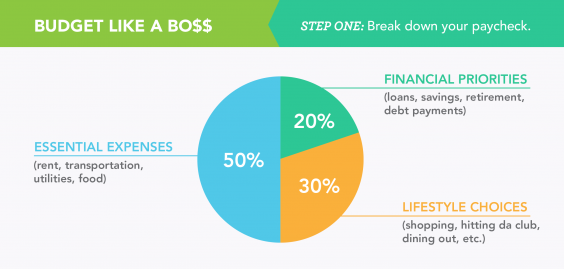

BUDGET

Handy Tips to Stress Less

- Be realistic. If you’re working an entry-level job, don’t expect to buy designer shoes and fancy meals every week.

- Be tough. Learn to say no or find creative replacements for pricey items or experiences.

- Reassess often. Look over spending and reevaluate every 1-2 months.

Always going over? Try these strategies:

- Evaluate your lifestyle honestly. To make ends meet, it may be necessary to cancel magazine subscriptions, stop ordering out for lunch, or forego cable TV.

- Reorganize your “lifestyle choices” budget. Prioritize and allocate more money for stuff you enjoy (e.g., going out to eat versus shopping).

- Try a cash budget. Each month, allocate specific amounts of cash for things like food, bars, movies, and clothing, and divide the money among labeled envelopes. When an envelope’s empty, you’re done spending for the month.

Budget Fun: How to Socialize and Save

- Entertain at home. Ask buddies to chip in for booze (or BYO) and crank up the jams.

- Get outside. Parks are free (and pretty) venues for socializing. Bring some games or sports equipment, a picnic, and some tunes.

- Do your homework. Many cities and towns offer free cultural events (museums, art shows, concerts, movies, etc.) every week.

- Think outside the box. You don’t need to spend money to hang with friends. Instead of meeting a pal for coffee, ask them to join you for a walk or bike ride around the neighborhood.

SAVINGS

Many financial planning resources recommend saving 20 percent of each paycheckeach month. Start out adding those savings to a “rainy day fund” for emergencies (or sudden unemployment) that contains between three and six months of net pay. Once the emergency fund is sufficiently stocked, put the monthly 20 percent towards longer-term goals — a house, a car, or a luxurious vacation.

For many people just scraping by, putting away that much sounds superhuman, if not totally impossible. But rest easy! Saving doesn’t have to be Herculean.

Types of Savings Accounts

Note: Most savings (and checking) accounts have a monthly “maintenance fee” between $5 and $20. Avoid the fee by keeping a minimum sum in the account (usually between $300 and $500; exact amount varies from bank to bank) or by arranging a recurring transfer or direct deposit into the account.

- Regular Savings Account. A basic account for beginners. Pros: Low commitment, earns more interest than in a checking account. Cons: Low returns (a.k.a. extra money earned through interest).

- Certificate of Deposit (CD). Good for long-term saving. Pros: High interest returns with rates rising every year. Cons: Very inflexible. Most can’t be touched for 3 months to 5 years, and withdrawing early can result in a fee.

- Money Market Account (MMA). Middle ground between Regular Savings and CD. Pros: High interest, more flexibility than a CD. Cons: Limits on withdrawals, and many require a high minimum balance.

All About Interest

Interest is tricky; it can either help you or seriously stab you in the back. Here’s how it works:

- Interest is a fee charged for borrowing money — and it goes both ways. Banks pay interest for the ability to “borrow” your money and lend it out to other people and businesses. Consumers pay interest on credit cards, loans, car payments, and other instances when they borrow from the bank. It’s awesome for savings accounts (when the bank pays interest), but less so for loans (when you pay interest).

- Compounding interest refers to how often interest is calculated and added to your account (for example: annually, monthly, weekly). The more often it’s compounded, the more money you make (or owe).

- Online banks, MMAs, and high-yield savings accounts (those meant to generate lots of interest) tend to have much higher annual yields (between .80 percent and .90 percent) than basic savings accounts at brick-and-mortar banks.Higher-yield accounts also tend to have higher maintenance fees and minimum balances, so read the fine print before signing anything!

DEBT AND LOANS

How to Deal with Debt

- Pay off “bad debt” (especially credit cards) first. These debts easily spiral out of control.

- Don’t take on debt you don’t need. Live frugally and don’t exceed your means, and study your financial situation before taking on any necessary new debt.

- Look for lower interest rates that compound less often. There are tons of banks, credit card companies, and car dealerships, so there’s almost always a better deal out there.

- Always read the fine print. And if you don’t understand the jargon, ask questions or consult someone with fine-print-reading skills!

- Keep saving while you pay off debt. Remember that 20 percent of your paycheck goes to “lifestle priorities” — figure out the best way to divvy up that amount so you can pay off debts and add to savings simultaneously.

RETIREMENT

Types of Retirement Accounts

The main difference between types of retirement accounts is how the IRS taxes the related contributions and interest.

- With traditional IRA and traditional 401k accounts, you’re taxed when the funds are withdrawn after retirement.

- By contrast, money goes into a Roth IRA or Roth 401k after taxes, so the user does not have to pay taxes on either contributions or interest when they withdraw from the account.

- You can open a traditional and a Roth IRA at the same time, but the maximum contribution for both accounts is $5,500 per year combined.

Some banks and brokerages offering Traditional and Roth IRAs require minimum balances to prevent maintenance charges; however, it’s often possible to avoid these charges by scheduling regular contributions into the IRA from savings or checking accounts.

- 401k. Only available to people whose employers offer 401k plans. Stashes away money from each paycheck, so it stops accumulating if you find a different job (most companies will allow you to “roll over” your previous 401k into the new company’s 401k account). Some companies will “match” what you save, resulting in a higher yield (free money!). Also, some companies offer both traditional and Roth 401ks so employees can choose what works for them.

- Traditional IRA. All contributions are tax deductible, and you don’t have to pay taxes on interest. On the down side, you’ll have to pay taxes on both contributions and interest when you withdraw. Anyone who takes out money before age 59½ must pay a 10 percent penalty fee (of the amount withdrawn) and taxes on the money. Regular withdrawals are mandatory beginning at age 70½. Anyone, regardless of age or income, can start a traditional IRA. This type of IRA is best for those currently in a high tax bracket who believe they will be in a lower bracket at retirement age.

- Roth IRA. With a Roth fund, you’ll pay taxes on deposits but not withdrawals. These accounts are not open to anyone — single tax filers making over $137,000 (or $188,000 for a couple) per year cannot open Roth IRA accounts. The income limitations change every year to adjust for inflation. To contribute the maximum amount each year ($5,500 for those under 50, $6,500 for people 50+) in 2013, a singleton’s gross annual income must total less than $112,000, and a married couple less than $178,000. This type of retirement fund is more flexible about withdrawals. However, you’ll have to pay a 10 percent fee on all interest if withdrawing before retirement age.

Note: Investing in stocks and bonds is a great way to contribute to a retirement fund, but it’s outside the scope of this article. Consult a financial planner or trusted advisor if you’re interested in more complicated investments.

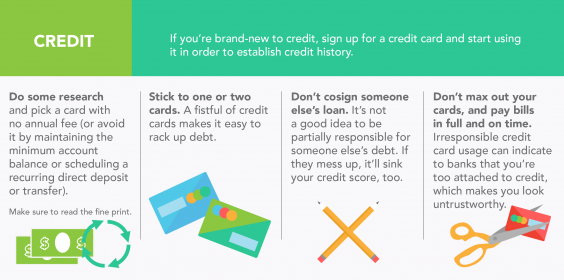

CREDIT

Credit scores determine interest rates for things like mortgages, car loans, or regular bank loans. They tell bankers how likely you are to pay everything back (and they can also determine whether you’re approved to rent a house or apartment). Here’s what you can do to nurture and protect your budding credit:

Call Help With My Credit, DebtAdvice, Take Charge America, or another independent, free service for advice. Options may include:

- Payment holiday: Allows you to skip a month or two of paying the credit card bill (although you’ll still accumulate interest and must pay eventually).

- Balance negotiation: Call the credit card company to negotiate for a better interest rate, change the payment terms, or to reach a settlement. If you’rereally behind on payments, creditors may reduce the balance by 50 percent or more.

- Debt management plan: Work with creditors to set up a monthly payment plan to pay off debts.

- File bankruptcy: Declaring bankruptcy stays on your credit record from between seven to ten years, so try not to let debt get to this point (and consult an expert you trust before making any decisions).

Special thanks to Ellen Derrick, a CERTIFIED FINANCIAL PLANNER™ with LearnVestPlanning Services.

Illustrations by Kim Steinhilber.

No comments:

Post a Comment